By Kemo Cham

Claim: In October 2023, the Sierra Leone government introduced a new Goods and Services Tax (GST) levied by the National Revenue Authority (NRA) on mobile money transactions. In the face of public concerns, the government and mobile operators said it didn’t add any new charges on the customer.

Verdict: It has been established, however, that contrary to the claim by the government and the mobile operators, the new fee is actually borne by the customer, which has made the cost of mobile money transactions in the country go up, becoming more expensive. This is shown through copies of electronic receipts of transactions from various users, including the author, before and after the introduction of the tax.

Full text

Sierra Leone has one of the lowest rates of financial inclusion in Africa. According to the United Nations Capital Development Fund, as of 2021, only about 20% of adults in the country’s over eight million population had a bank account. This has been largely blamed for the high levels of poverty in the country.

Mobile money services were seen as a catalyst to expand financial inclusion. The services have been very useful, particularly for people engaging in small and medium-sized businesses. But a considerable number of people also rely on the services to remit cash to their families, particularly between the capital, Freetown, where much of the services are concentrated, and the provinces, in places with little or no formal banking system, of which there are many across the country.

Also, many organisations, both government and non-government – use mobile money services to pay short-term workers. This way, the service has become very popular, estimated to be valued at NLe10 billion (Roughly USD500,000) as of 2019, according to the International Monetary Fund (IMF).

Based on the pertinent Financial Act, a 15 per cent charge is applied to all fees associated with transactions conducted via the mobile money transfer system as GST. The National Revenue Authority (NRA) has clarified that this tax was actually established 15 years ago under the GST Act of 2009, with its implementation being postponed until recently.

The move to introduce the new tax and, consequently, the new charges sparked a huge public outcry amid concerns over its potential implication on the ordinary man who is already struggling to deal with an already brutal economic reality.

Many people criticised the decision, accusing the government of neglecting the suffering of the masses.

But prior to the introduction of the GST, the NRA had said that the operators and not the customers would bear the tax burden. Reports also suggest that there was a prolonged debate between the NRA management and the operators over this issue.

Charges on mobile money transactions are usually done on cash-out transactions. Under the previous arrangement, a transaction amount of up to NLe100 attracted a charge of NLe3.05 and NLe1000 transactions attracted a charge of NLe20.

With the new tax, the charges have additional NLe0.46 and NLe3, respectively.

The operators, in their statement “clarifying” the issue, failed to speak on it clearly, ironically, instead giving the impression that the customer doesn’t bear the burden.

“It’s essential to note that the 15% GST is applied to the transaction fees and not to the cashout amount itself. This change will impact individuals who frequently utilise mobile money services for their financial transactions, and it’s part of Sierra Leone’s efforts to align with the updated tax regulations,” the operators said in a joint statement.

When engaged in a public discussion for a proper explanation, John Conteh, a spokesperson for Africell, one of the two leading operators in the country, insisted that the tax would be deducted from the charges, which belonged to the operators. Not the customer’s money; in my engagement with him on Facebook, he said the customer would bear no new cost.

For the public, the concern was whether the new tax would result in a reduction of their money when they do transactions. Every evidence and testimony from users of the service point to the fact that customers are indeed paying for the charges and that the new tax has led to reduced monies due to the fees charged, contrary to the claims of the operators. A contradiction that needs to be verified.

Verifications

It has been verified that the new charges are indeed added to the old fees, which means that the user now has to pay more money as fees for every transaction.

The verification was done through analysis of statements from both the government and the operators, as well as the new rates released by the operators.

The author also analysed transaction receipts of people who have used the services since the new GST was enacted.

Among them is a popular businessman, Martin Micahel, who confirmed the introduction of the tax via a post on X, the social media platform previously known as Twitter, where he displayed receipts of transactions of the same amount he did before the introduction and after the introduction.

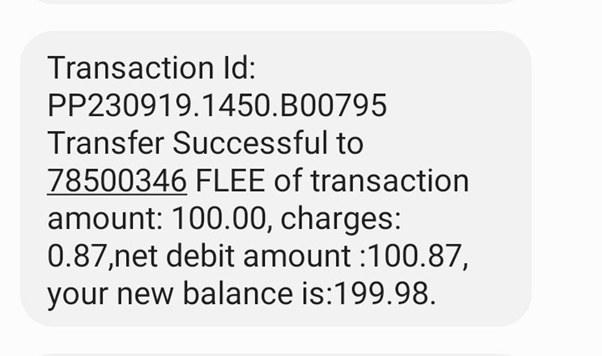

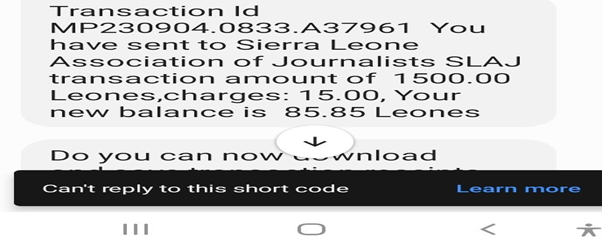

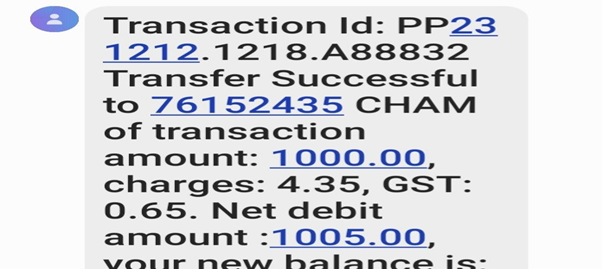

Another service user, Nancy Moses, shared electronic receipts of transactions (in screenshots below), which indicate charges were deducted from the monies she sent.

This author also made comparisons of several transactions before the new text. After the introduction (copies of electronic receipts below), all showed that additional charges were deducted contrary to the government’s claims.

Conclusion

With the introduction of the new GST on mobile money services, users of the service have to pay more money on the fees charged per transaction, contrary to what the operators and the government said. Since the government said it charges the GST on the fee charged by the service provider, the operators raised the cost of the fee.